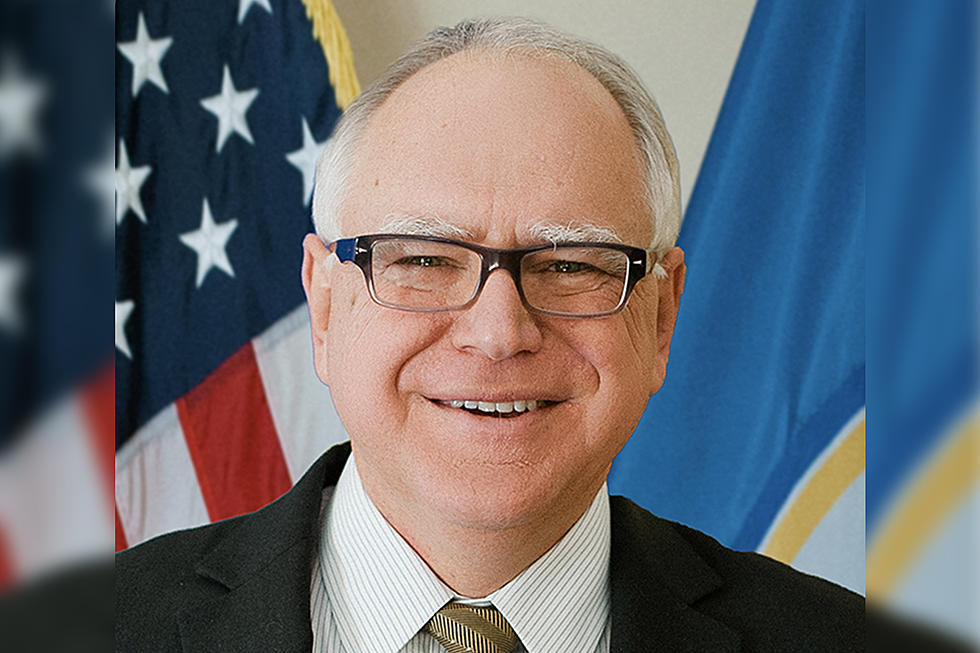

Gov. Walz Unveils Budget Proposal Offering Education + Broadband Funding, 20-Cent Gas Tax Hike For Road Projects

As Tim Walz works his way into the opening weeks of his term as Minnesota's Governor, he announced Tuesday a two-year budget for Tithe state between $47 billion and $50 billion that includes increases in funding for things like education and human services, but also includes a proposed 20-cent per gallon gas tax increase.

KARE 11 details $733 million in new spending on pre-kindergarten through 12th grade education, $158 million on higher education, and $284 million in new spending on health and human services that includes state health insurance subsidies to reduce premiums. $70 million in funding for a broadband internet grant program to expand high-speed internet access by 2022 was also included in the budget.

Another part of the proposed Walz budget is a transportation projects plan, which looks to add a 20-cent per gallon gas tax on to fuel purchases to fund said transportation projects.

FOX 9 explains that this gas tax increase would increase Minnesota's gas tax by 70%, going from 28.6 cents per gallon to a proposed 48.6 cents per gallon. When also figuring in the federal gas tax rate of 18.4 cents per gallon, Minnesotans would be paying a total of 67 cents per gallon in combined state and federal gas tax under this plan.

This proposed increase to 48.6 cents per gallon would make Minnesota's state gas tax rate the fourth highest in the country, behind Pennsylvania (58.70 cents per gallon), California (55.22 cents per gallon), and Washington (49.40 cents per gallon) (via Kiplinger).

This proposed increase would also move Minnesota from one of the lowest state rates in the Midwest to the highest.

- 48.6 - Proposed Minnesota Rate

- 32.9 - Wisconsin

- 30.5- Iowa

- 30.0 - South Dakota

- 28.6 - Current Minnesota Rate

- 23.0 - North Dakota

The proposed state gas tax increase would reportedly raise $6.5 billion over 10 years, and an additional proposed increase in motor vehicle registration tax and vehicle sales tax would also add an additional $4.5 billion that would be devoted to road, bridge, and other infrastructure projects around the state.

More From B105